SECTION 10: Loan Document Package Contents

The loan packages you will work with consistently as a Notary Signing Agent are:

- First Mortgages;

- Second Mortgages;

- Mortgage Refinances;

- V.A. Refinances; and

- Equity Lines of Credit.

You can become familiar with the documents used in these transactions by utilizing your search engine on the internet. There are websites that allow you to download blank forms. You may have some of these forms in your own files as well; especially if you are a homeowner – look at the loan documents involved with your own mortgage(s).

We will now go over some of the most commonplace documents involved in a loan signing. Examples have been recreated and provided as a visual aid for your general knowledge only. All documents vary depending upon the loan, the lender, the geographical location, type of loan, terms of the loan, state laws, etc. They are not presented in the order of loan document packaging – they are presented in alphabetical order.

Do not use these forms for any purpose other than for general familiarity.

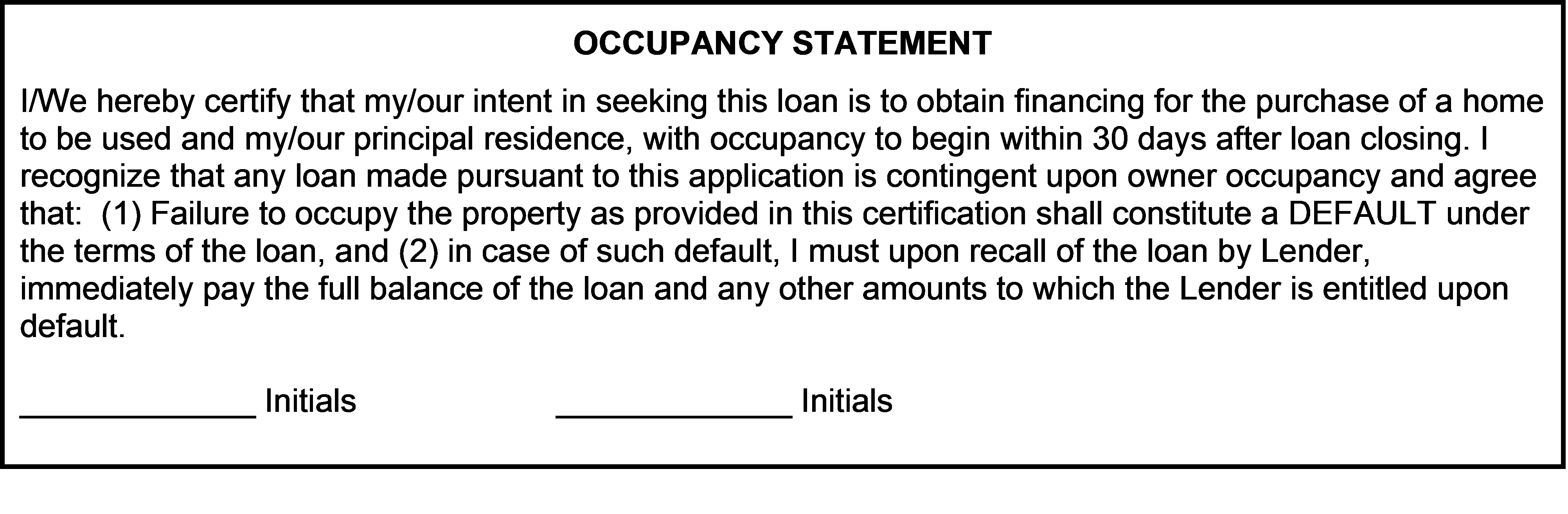

Affidavit or Certificate of Occupancy (CO)

This document states that the borrowers intend to reside in the subject property or to use the property as a secondary residence or investment property.

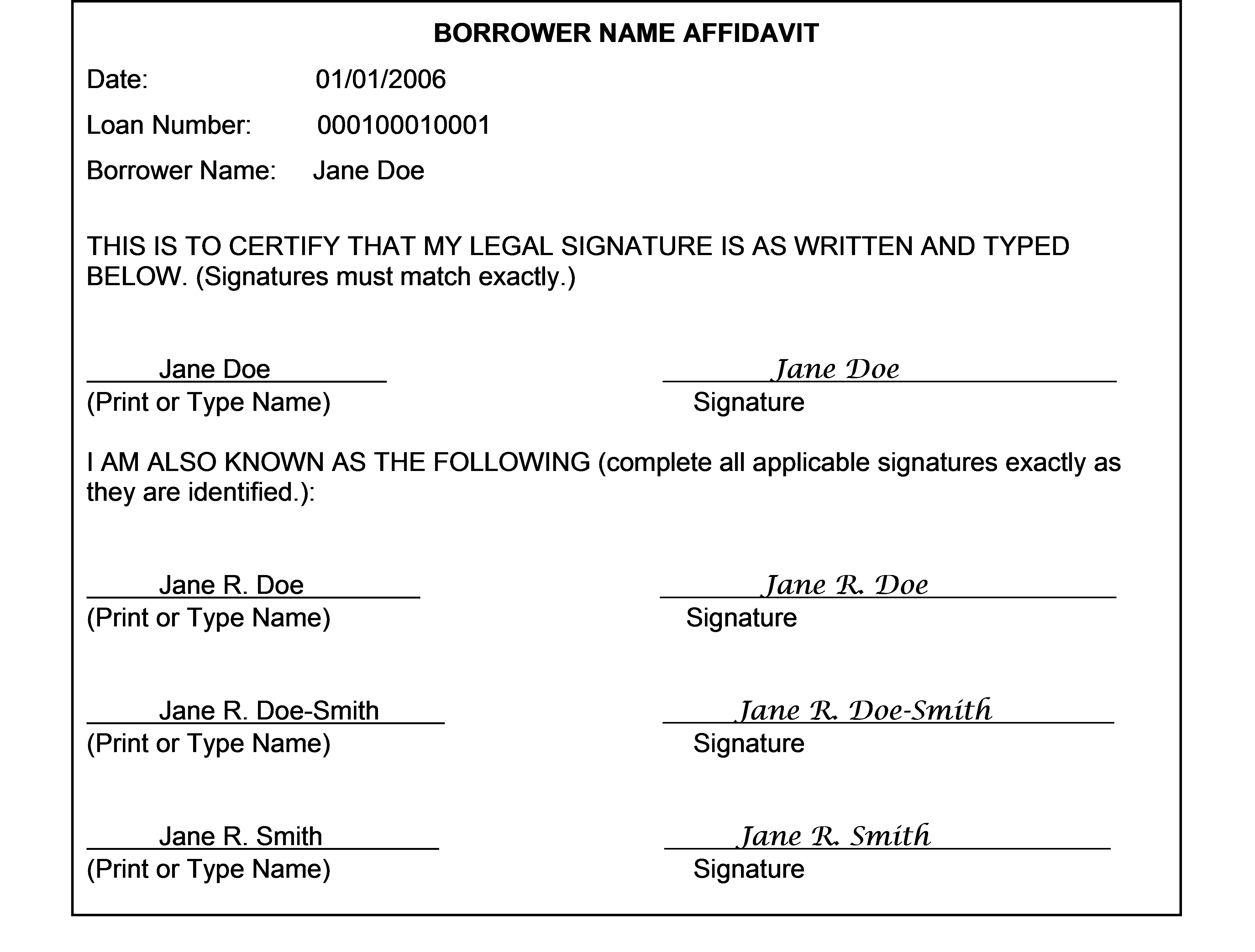

Borrower Name/AKA Affidavit

This document lists all current and former names used by the borrowers (i.e., maiden name, married name, etc.).

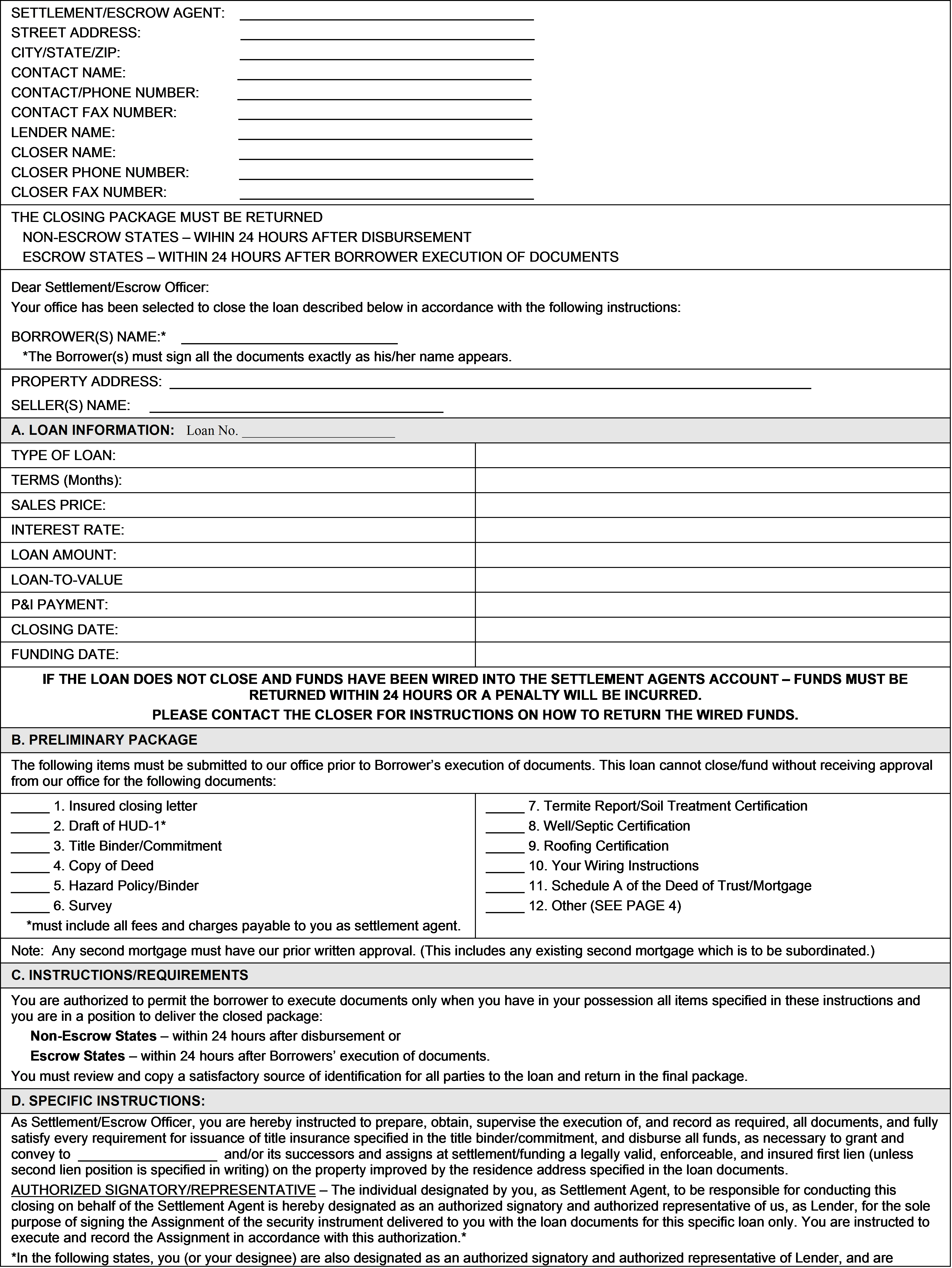

Closing Instructions

This document outlines the contents of the loan document package. It contains the computation of financial adjustments between the buyer and seller, as of the day of closing a sale, to determine the net amount that the buyer must pay to the seller to complete purchase of the real estate and to define the seller's net proceeds. (Also known as a Settlement Statement.)

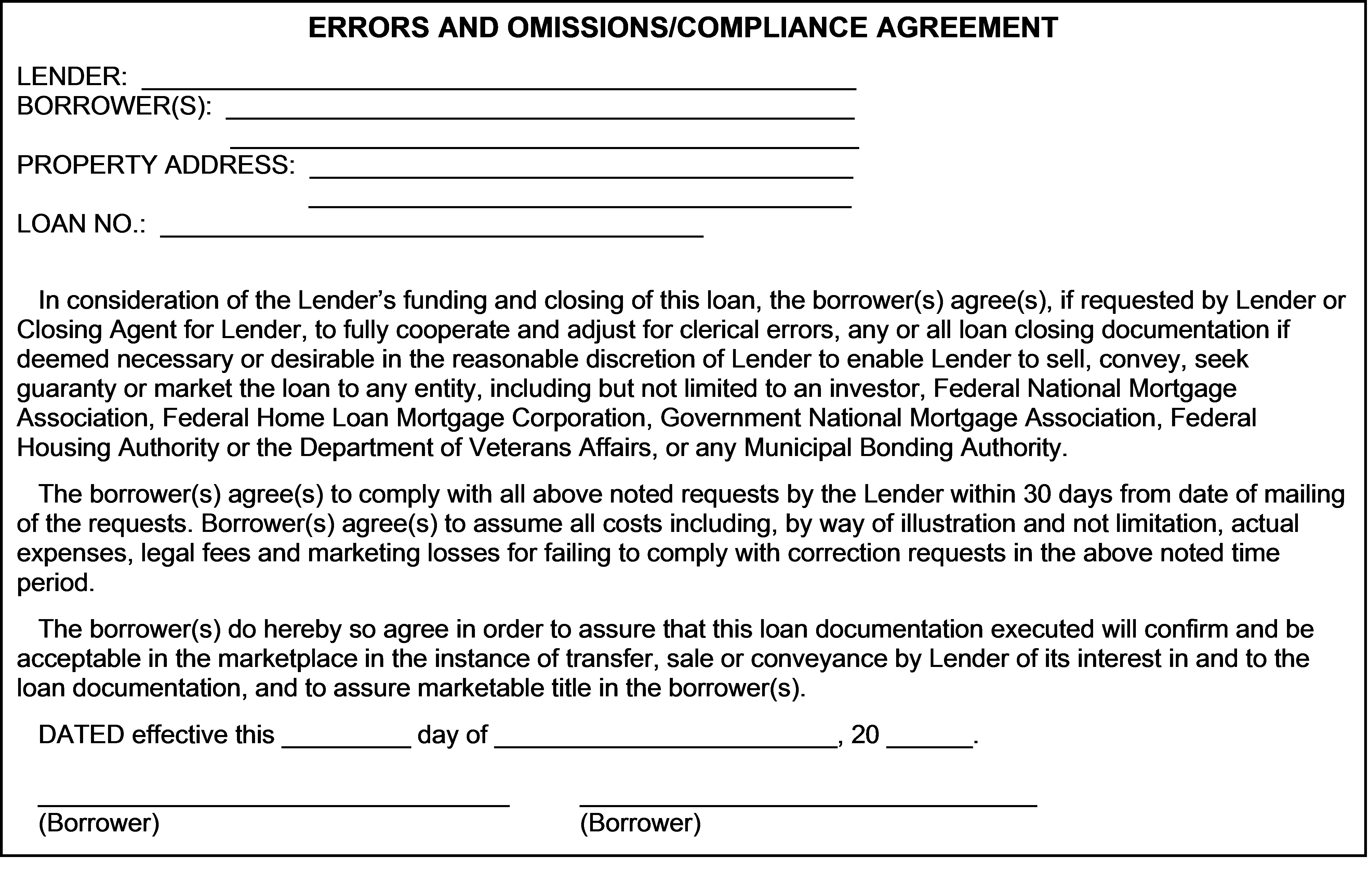

Correction Statement and Agreement or Errors and Omissions Agreement

This document offers protection in case any mistakes have been made on the loan documents. This form is for a buyer and seller to sign at closing, agreeing to execute corrected documents and to provide replacement documents in the event any documents are lost or misplaced.

Deed of Trust (DOT)

The Deed of Trust is like a mortgage whereby real property is given as security for a debt. In a Deed of Trust there are three parties to the instrument: (1) The borrower, (2) the trustee, and (3) the lender. The borrower transfers the legal title for the property to the trustee who holds the property in trust as security for the payment of the debt (mortgage) to the lender. The Deed of Trust is recorded with the county clerk's office as the legal document conveying title to the property. Be especially careful to note any addendums or riders that may be included as part of this document.

Escrow

Impound/Escrow Account

Once a purchase transaction is closed, the borrower may have an escrow account or impound account with the lender. This means the amount the borrower pays each month includes an amount above what would be required if he/she were only paying the loan principal and interest. The extra money is held in the impound account (escrow account) for the payment of items like property taxes and homeowner's insurance when they come due.

Escrow Transfer Request and Disclosure

This document is used to instruct the previous lender to transfer all funds being held in escrow for real estate taxes and/or hazard insurance to a new escrow account with the new lender.

Escrow Waiver Agreement

The document is used when the borrower does not want the lender to create an escrow account. The lender is then not responsible for paying taxes and insurance, the borrower is.

Statement of Insurance Requirements

This document outlines the amount of insurance coverage that must be kept on the property. If the borrowers have chosen to sign the Escrow Waiver Agreement and they do not fulfill the obligations set forth in the Statement of Insurance Requirements, the lender may secure the appropriate insurance coverage and bill the borrower accordingly. This can be very expensive for the borrower.

First Payment Letter

This document outlines the details of the first payment that is due on the loan – the payment amount due, the date due and where to send the payment. If the lender sends coupon books, the first payment letter will also inform the borrower when to expect the book in the mail.

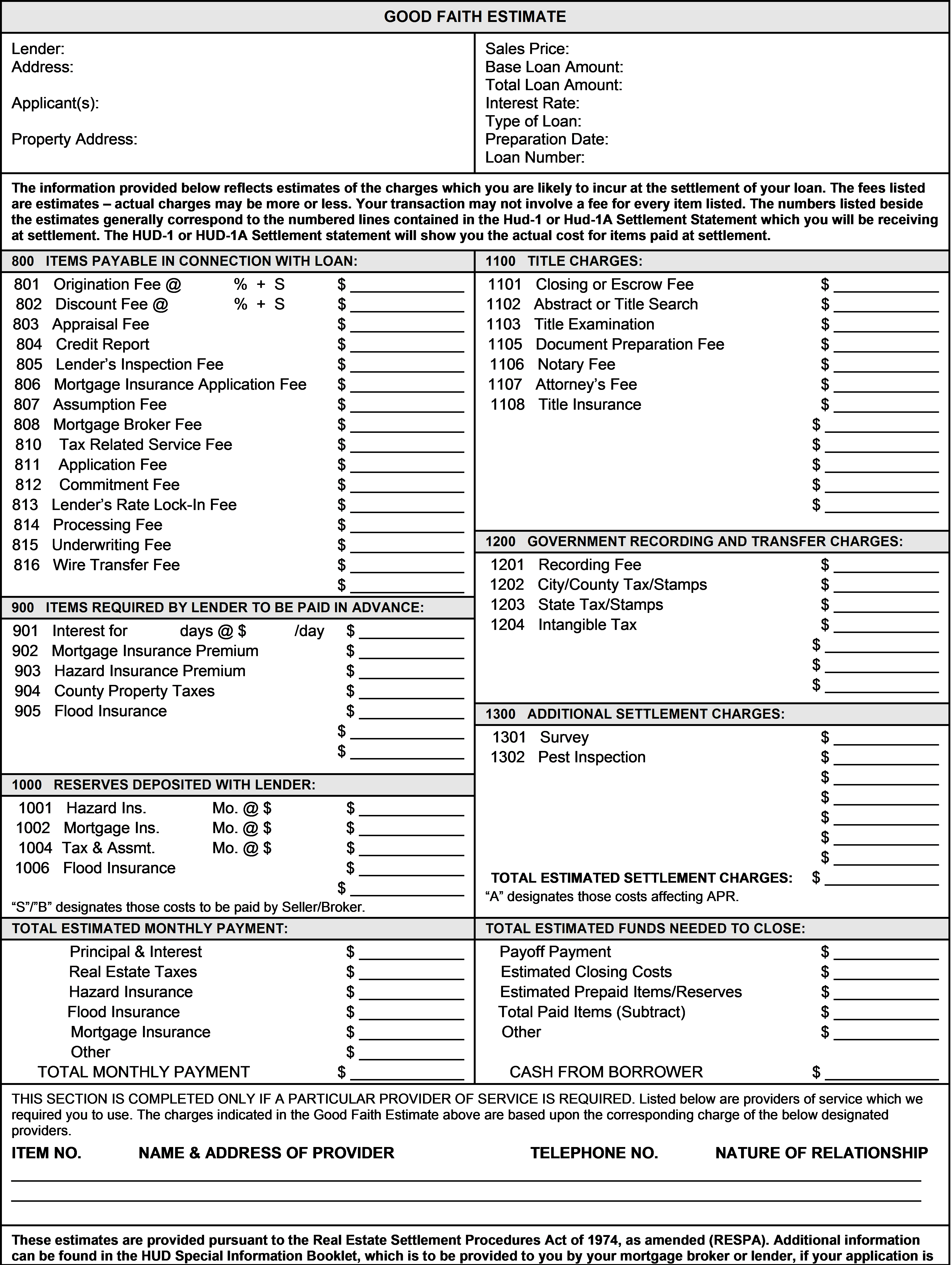

Good Faith Estimate (GFE)

A lender makes an attempt to estimate the amount of non-recurring closing costs and prepaid items on the Good Faith Estimate.

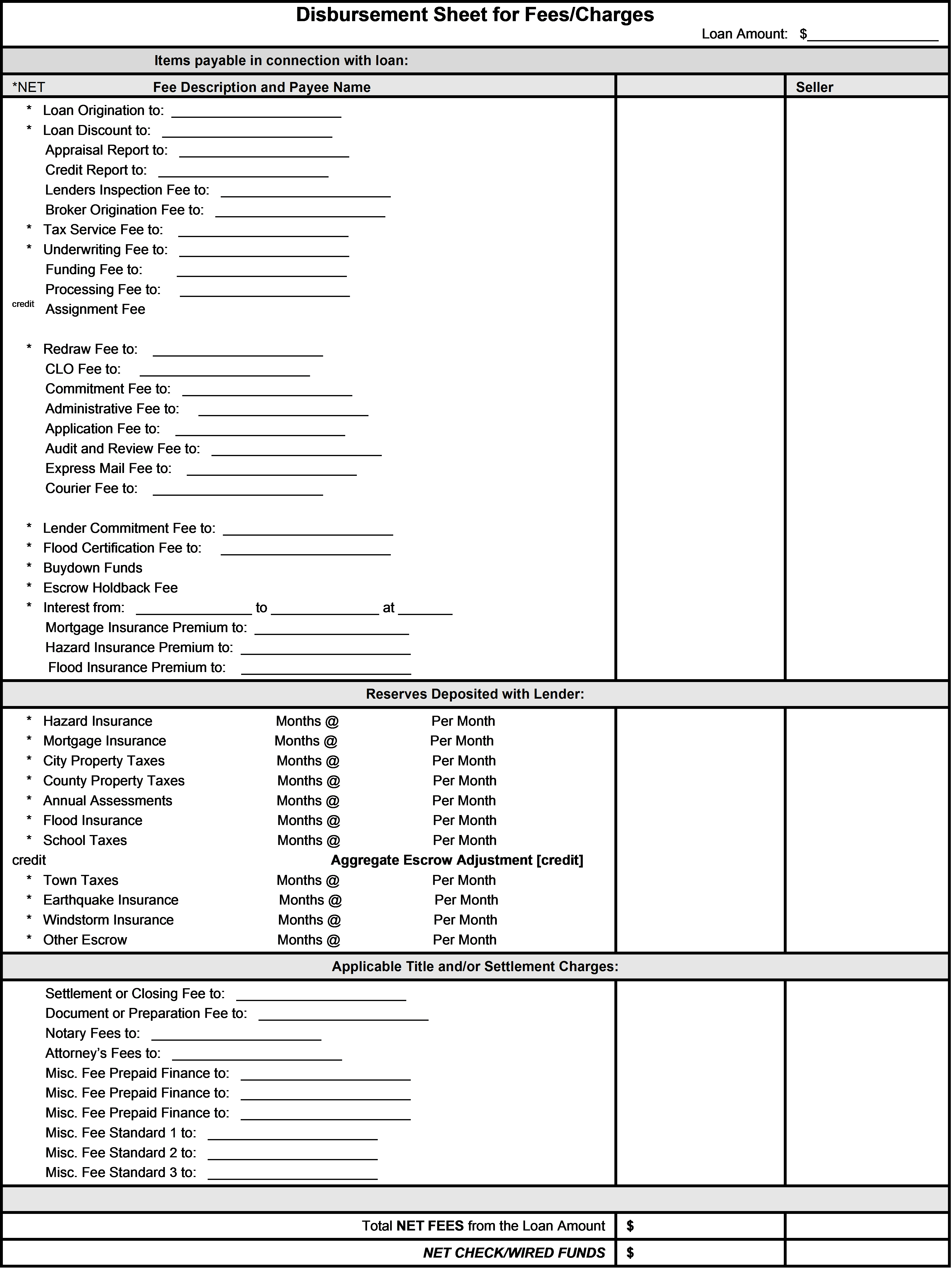

HUD-1 Settlement Statement

A document that provides an itemized listing of the funds that are payable at closing. Items that appear on the statement include real estate commissions, loan fees, points, and initial escrow amounts. The totals at the bottom of the HUD-1 statement define the seller's net proceeds and the buyer's net payment at closing.

Some lenders may require the Signing Agent to collect a check from the borrower for the funds due in the document and will instruct the Notary in what form the payment is to be made (i.e., personal check, cashier's check, etc.) and how to forward the payment to the lender. You may be required to fax a copy of the check to the lender before sending the completed loan package.

What happens if the borrower "forgot" to prepare a check? The answer to this question lies with the lender. You should follow their specific instructions. You may be asked to wait while the borrower prepares a check or you may be told to cancel the signing altogether.

This document is also known as the "Settlement Statement" and may contain an attached addendum (HUD-1 Settlement Statement Addendum) that requires the borrower's signature verifying that he/she/they understand(s) the document and do(es) not have any concerns that would prevent him/her/them from signing. Each item on the statement is represented by a separate number within a standardized numbering system.

A HUD-1 Settlement Statement may be downloaded from:

http://www.hudclips.org/sub_nonhud/html/pdfforms/1.pdf

(You may copy the above link and paste into your web browser.)

Note

The Note is the legal instrument that obligates a borrower to repay a mortgage loan at a stated interest rate during a specified period of time. This document works hand-in-hand with the Deed of Trust and the borrowers should pay special attention to the outlined terms. The Notary Signing Agent should allow the borrowers to examine this document closely as well and can point out the pertinent items such as the loan amount, interest rate, monthly payment, length of the loan, late fees and prepayment penalties (if any), the lending institution, property address, etc. Ensure that the date on the Note is the same as the date on the Deed of Trust.

Remember, you can point items out, but you cannot offer any advice. It is imperative that the borrowers understand this document. If any questions arise, you must refer them to the loan officer.

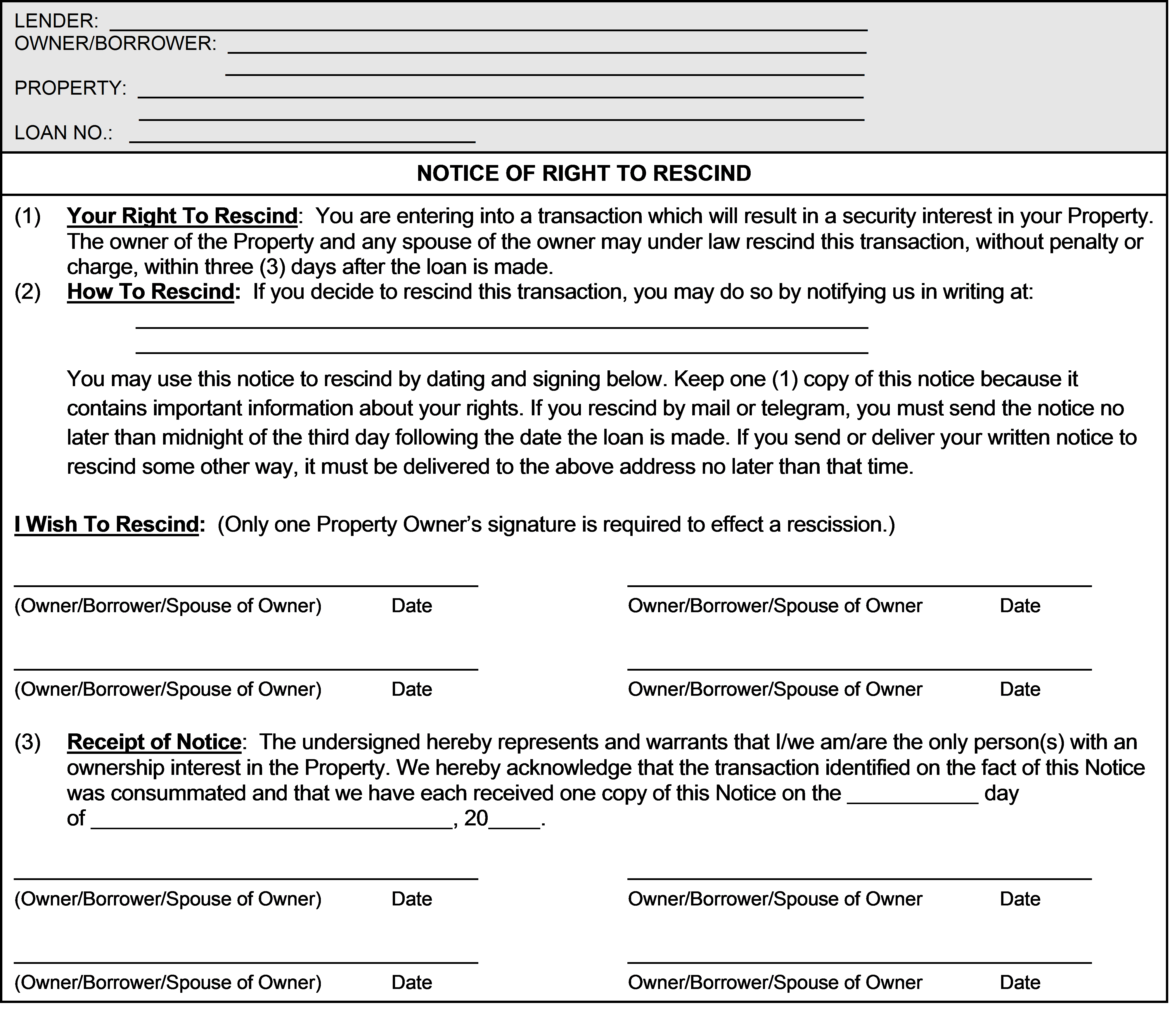

Notice of Right to Rescind (NORR)

The right of rescission (cancellation) is a consumer protection concept spelled out in Regulation Z (see also Truth in Lending Disclosure) that allows borrowers who pledge their homes as collateral on a loan to rescind (or cancel) the loan within three business days to allow for a "cooling-off period" after closing.

All persons with the right to rescind must receive a copy of the material disclosures, including the finance charge, the APR, the amount financed, the total number of payments, the payment schedule and two copies of the Notice of the Right to Rescind.

When calculating the three-day rescission period, count the days as Monday through Saturday (not Sundays or federal legal holidays, since the mail is not delivered on those days). The rescission period technically starts at midnight on the day following the signing and ends at midnight on the third day. For instance, if the signing is on a Monday, the rescission period would end at midnight on Thursday. The rule hinges more on mail delivery than on the financial institution's business hours; therefore, it is irrelevant if the lender's offices are open or closed on the weekends.

Once the three-day rescission period is up, the lender is free to disburse the funds to the borrower, being satisfied that no rescission has occurred.

Pointing the rescission period out to the borrower(s) can help alleviate some tension and, therefore, could speed up the signing process - the task then doesn't seem to be so daunting and so "final" to the signer(s).

Request for Copy or Transcript of Taxes (Form 4506)

Form 4506 is the document used to request a copy of the borrower's tax return from the IRS which is used to verify the income of the borrower. There is one document per borrower.

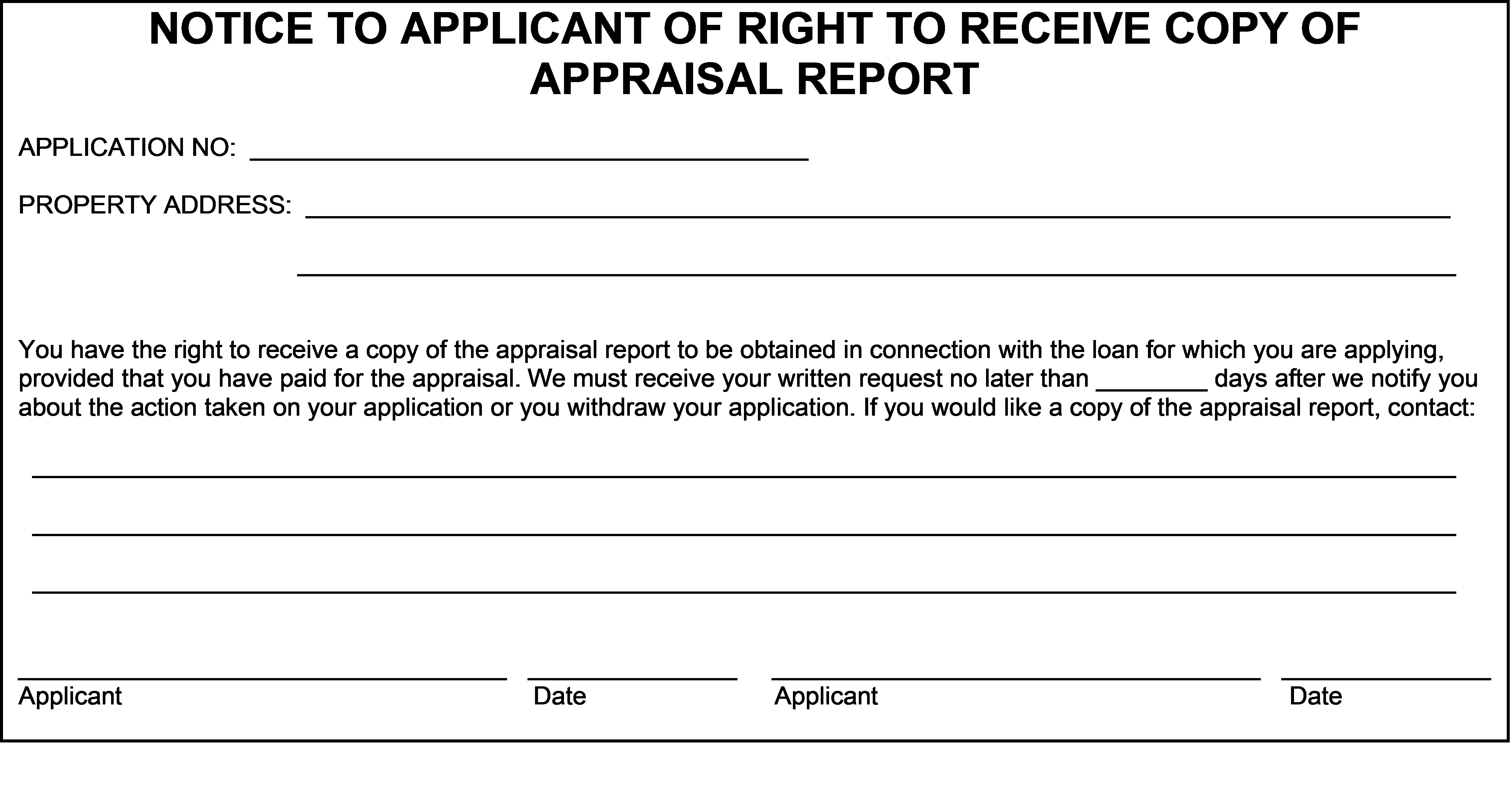

Right to Copy of Appraisal Report Notice

This document informs the borrowers that they have a right to receive a copy of the appraisal report that was performed by the lender.

Subordination Agreement

This agreement states that any other mortgage or lien on the property has a lower priority than that of the first mortgage. For instance, if the borrower had subsequently processed a second mortgage on a home, the first lender retains the position of priority and will be paid first in case of default.

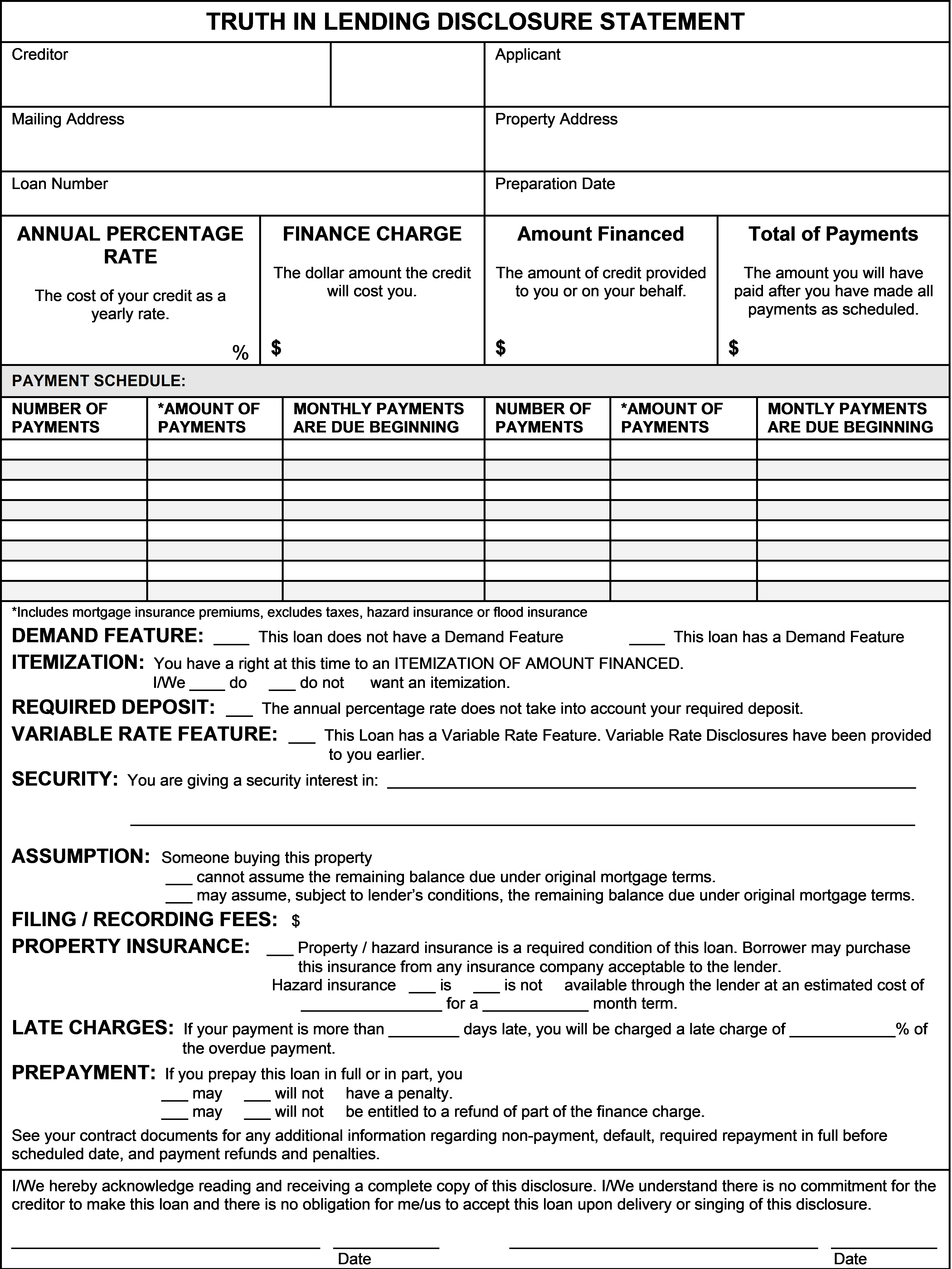

Truth in Lending Disclosure

The Truth-In-Lending Act (TIL or TILA) is a federal consumer credit protection law that requires lenders to fully disclose, in writing, the terms and conditions of a mortgage, including the annual percentage rate and other charges (see also Notice of Right to Rescind).

The law's stated goal is "…assure a meaningful disclosure of credit terms so that the consumer will be able to compare more readily the various credit terms available to him."

Verification of Employment (VOE)

This document provides employment information on the borrower. The borrower is testifying that he or she is employed, where, in what capacity, and at what compensation.