SECTION 11: Loan Terminology

- Adjustable Rate Mortgage (ARM) – An ARM is a mortgage in which the rate of interest changes periodically (up or down), according to corresponding fluctuations in the index rate. These mortgages may also be known as AMLs (Adjustable Mortgage Loans) or VRMs (Variable Rate Mortgages).

- Annual Percentage Rate (APR) – The APR is a measure of the cost of credit. It is a value created according to a government formula intended to reflect the true annual cost of borrowing, expressed as a percentage; includes interest, loan origination fees, credit life insurance, discount fees, and other costs of credit to reflect the actual annual cost of the mortgage loan.

- Appraisal – An expert judgment or estimate of the quality or value of real estate as of a given date.

- Assessed Value – A monetary figure determined for tax purposes by an assessor which reflects a property's worth and is used to compute a tax dollar obligation by multiplying it by a specific tax rate.

-

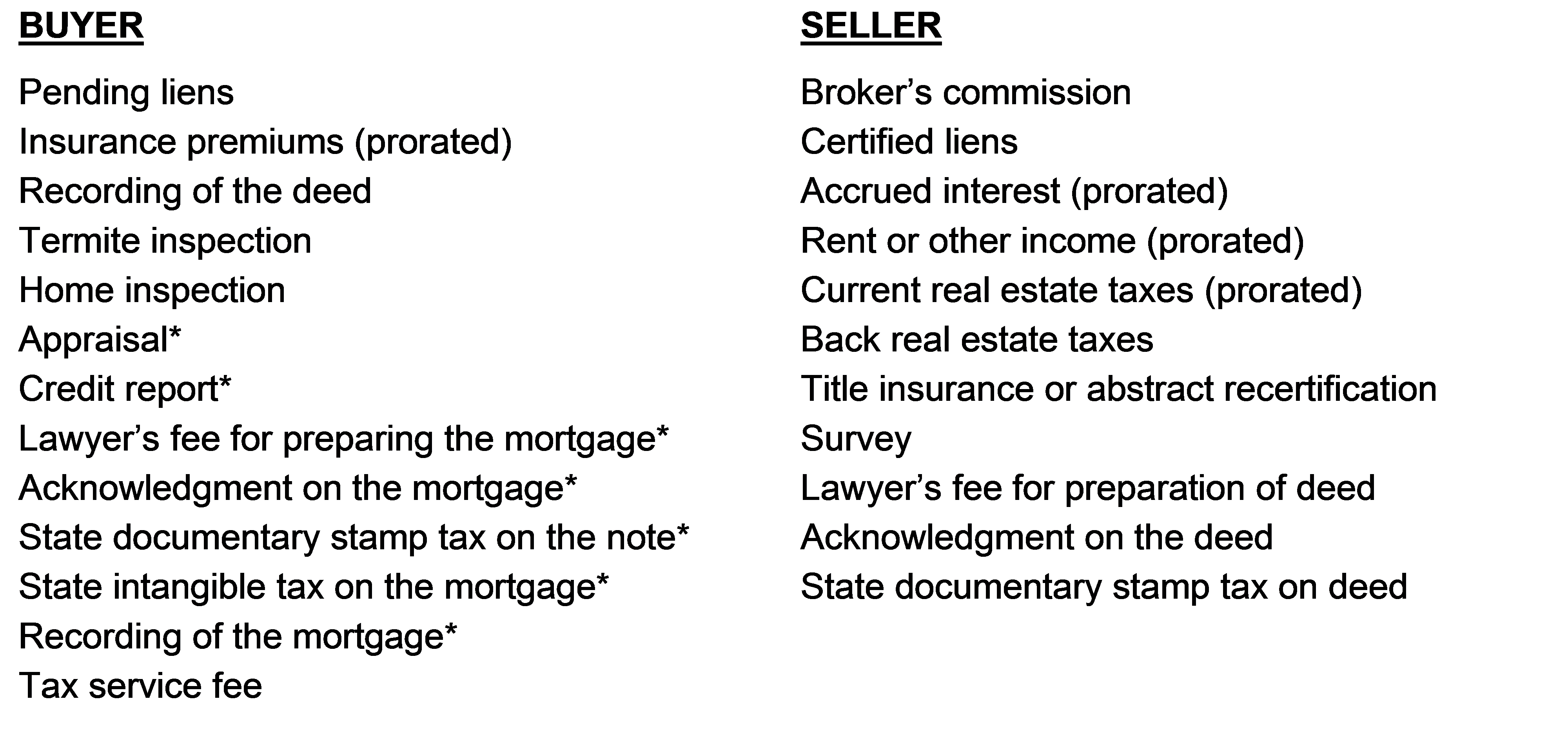

Closing Costs – Closing costs encompass the numerous additional expenses which buyers and sellers normally incur to complete the transfer of ownership of real estate. Closing costs are prepaid at the closing day and are separated into what are called "non-recurring closing costs" and "pre-paid items." Closing costs can include the following, typically broken down into buyer's expenses and seller's expenses:

*These expenses normally apply only if new financing is obtained.

- Closing Statement - A closing statement is an accounting to the buyer and seller for all financial aspects of closing a real estate transaction. It also accounts for the funds (deposit) held in escrow by the real estate broker. In formulating a closing statement, entries are made as debits or credits.

- Discount Points – A percentage of the loan amount calculated to help defray the cost of originating a mortgage. The discount points are paid in one lump sum at the time of the closing of a loan.

- Fixed Adjustable Rate – A loan that has a fixed rate of interest for a stated period after which time the rate becomes adjustable.

- Fixed Rate – A loan that has the same (fixed) rate of interest for the life of the loan.

-

Homestead Property Tax or Principal Residence Exemption - The Homestead Exemption affords homeowners a tax break on the property used as their primary residence. If the homeowner decides at some point to no longer primarily reside in that property, the exemption must be canceled or severe tax penalties will come into play.

Some states don't have the Homestead Exemption program and other states' exemption amount varies. Check with your state to know the particulars.

- Interest Rate - The interest rate reflects the risk of doing business with a particular borrower as well as market risk – interest is the return on the bank's investment.

- Nonrecurring Closing Costs (N.R.C.C.) - Non-recurring closing costs include any items which are paid just once as a result of buying property or obtaining a loan.

- Notary Fee - The notary fee is collected by the lender and pays for the expenses of hiring a Notary Signing Agent. It is not the fee that the Notary Signing Agent receives, however.

- Overnight Fee Statement - The lender will charge a fee to send the payoff of the loan by overnight messenger service to the previous lender. The borrower acknowledges that he/she is aware of this charge through this statement.

- Paid Outside of Closing (P.O.C.) - These are expenses that are not included in the closing costs, such as if the lender had requested an appraisal or credit report that the borrower had to supply and pay for before the loan process could proceed.

- Payoff Statement - If prepayment occurs before a loan has been fully amortized as agreed, this statement details what the current amount is to pay off the present mortgage. For instance, in the case of refinancing, the new lender pays the previous lender a specific amount to pay off the first loan producing clear title of the first loan.

-

Prepayment Penalty - A fee that may be charged to a borrower who pays off a loan before it is due. For instance, a prepayment penalty clause may state:

"In the event the note and mortgage provides for a prepayment penalty the amounts of that penalty shall be as follows: Prepayment months 1-12, 3.75% of the outstanding principal, in months 13-24, 1.25% of the outstanding principal, thereafter zero. All other terms provided for shall apply. Prepayment caused by foreclosure of this loan shall attract the same, above prepayment penalties."

- Principal - The principal is the amount borrowed or remaining unpaid on the loan. In the monthly payment, the principal is the part of the payment that reduces the remaining balance of the mortgage.

- Recurring Closing Costs - Recurring closing costs include those closing costs that are prepaid on a continuous basis, such as insurance or taxes.

- Term - The term of the loan is the actual time the loan is active until its maturity date (date of loan payoff).

- Title Fees - Title fees cover expenses incurred to perform a search of the title records to ensure that the seller is the legal owner of the property and that there are no liens or other claims outstanding.